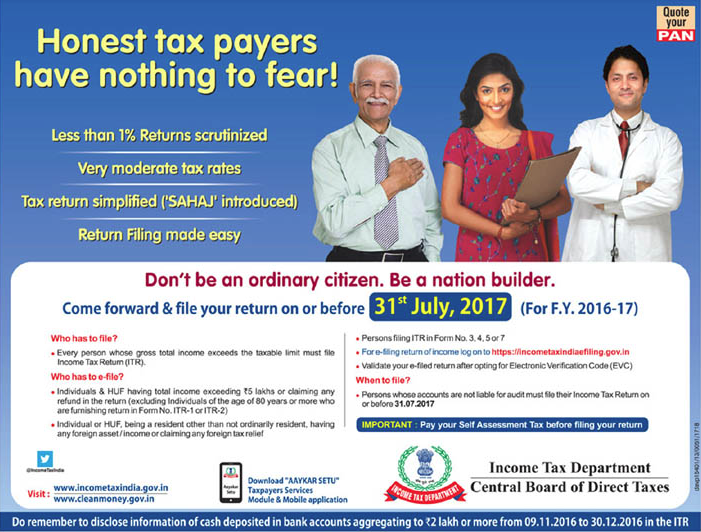

Did you know that only taxpayers contribute to nation building, and those who do not pay any taxes are just ordinary citizens. That’s how, it seems, the Income Tax Department and Central Board of Direct Taxes categorize the citizens of this country. Recently, I came across this ad/announcement from the Income Tax Department/Central Board of Direct Taxes (CBDT) in a newspaper. The following statements in the ad/announcement caught my eye:

Don’t be an ordinary citizen. Be a nation builder.

So, you have to be a taxpayer to be a nation builder ? A non-taxpayer cannot be a nation builder? OK, got it!

I don’t know about you all; however, I do have many problems with the assertion by the IT Department/CBDT that you are just an ordinary citizen if you aren’t paying any income tax.

- Not everybody has to file a tax return. They, themselves, acknowledge that in the ad/announcement in the newspaper, “Every person whose gross total income exceeds the taxable limit must file Income Tax Return.” Matter of fact, 93% of Indian households earn less than ₹2.5 lakhs and don’t have to pay any taxes. Therefore, is it IT Departments’/CBDT’s claim that 93% of Indians are just ordinary citizens and not contributing to any sort of nation building?

- Only 6.3 crore (~5%), out of 125 crore, Indians pay taxes. Hence, it probably means that 95% of the Indians are just ordinary citizens, correct?

- Farmers, who feed the nation, don’t have to pay any taxes even if their income is more than ₹2.5 lakhs. Consequently, they too must not be nation builders, but just ordinary citizens.

- Many people working for the Indian Armed Services and guarding our nation’s borders probably earn less that ₹2.5 lakhs per annum and are, therefore, not liable to pay any taxes. Are they just ordinary citizens, too?

- Daily wage labourers who are building our nation’s roads, railways, airports, apartments, villas, palatial bungalows, etc., and who earn less that₹2.5 lakhs are probably just ordinary citizens, too. No?

- Many teachers earn less than ₹2.5 lakhs/annum and do not have to pay any tax. Ordinary citizens…

- I am sure that many employees of the IT Department/CBDT do not earn more than the taxable limit. Ordinary citizens, then?

- Many members of SC/ST/OBC communities are tax exempt under Section 10 (26) of the Income Tax Act, 1961. Therefore, they too are not nation builders, right?

Need I go on? Shouldn’t the IT Dept/CBDT know better than to categorize Indians in such a questionable manner?

Fallacious argument

The genius, or the geniuasses, who came up with that statement probably does not realize that the argument put forth by the IT Department/CBDT is fallacious. In my opinion, the assertion suffers from one or all of the following logical fallacies.

- Argumentum ad Populum

- Appeal to emotion

- Hasty generalization

- Either/or (Either pay taxes and be a nation builder or be an ordinary citizen.)

- Appeal to authority (Since the IT dept/CBDT is saying it; therefore, it must be true)

- No true Scotsman

- Black and white

By the by, I’m a nation builder. Don’t audit my returns, please. I promise to not criticize you again. Pinky promise!